Inefficient accounts payable practices result in late payments and lack of visibility which hurt your business. If this is something you are experiencing, you have probably examined outsourcing or automation. Each approach has its advantages, but the key is finding the perfect fit for your company’s needs.

As your business grows, so does the mountain of paperwork that comes with it. This can squeeze your accounts payable (AP) team—after all, they’re only human.

Even a few unpaid or late bills can add up to create big problems for businesses all over the world — to the tune of $3 trillion every year. Managing your bills well helps you maintain steady cash flow and nurture strong relationships with the companies that supply you with goods or services.

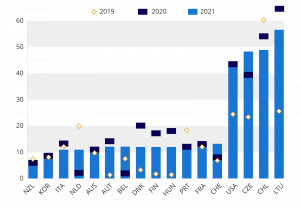

Source: OECD – Payment Delays by Country

When the AP workload starts to pile up, organizations look at two solutions: they either try accounts payable outsourcing, which means a third-party handles AP tasks, or use AP automation software internally that makes everything faster and more accurate.

Both ways aim to make paying bills smoother and more efficient. So, what’s the difference between outsourcing accounts payable and automation?

Outsourcing vs Automating Accounts Payable

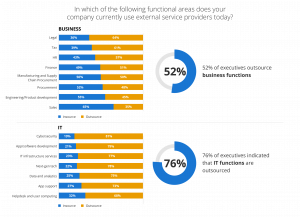

Outsourcing of departments is a common move for companies, especially in areas like IT and software development. However, there’s also a fear of losing grip on operations and watering down the quality of what gets done — an issue that outsourcing won’t fix. The numbers support this notion of distrust, with 21% of businesses starting to hand back the reins and bring IT operations back in-house.

Source: Deloitte

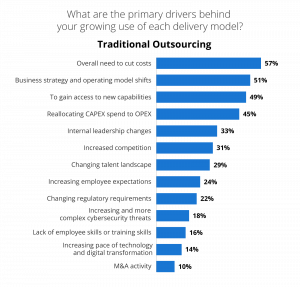

This difference is telling: Saving money through outsourced accounts payable services doesn’t automatically mean that you’ll see better AP workflows or boosted efficiency.

In fact, when looking at the numbers, cutting costs is the number one reason why businesses choose the outsourcing option. The decision to outsource doesn’t always prioritize operational speed and efficiency.

Source: Deloitte

In finance circles, as businesses work out how best to refine their AP functions, they’re realizing it isn’t all about cutting corners financially.

Striving for better performance in accounts payable leans heavily on automation as a solution, one that marries cost-saving prowess with gains in oversight, precision, and clarity.

Pros and Cons of Outsourcing Accounts Payable

The Benefits of Outsourcing Your AP Department

So why might you consider accounts payable outsourcing?

First, it might be easier on your budget since you’re not paying for full-time salaries or benefits of outsourced workers, and that’s generally good news. Plus, if you’re still struggling with a talent shortage, outsourcing lets you tap into workers you don’t have to find and hire yourself.

Outsourcing accounts payable also means flexibility. If things get busy all at once or quiet down unexpectedly, you won’t have to scramble to hire more people or figure out what to do with extra staff during slow periods.

Another plus is focus: When your team isn’t bogged down in routine payments and paperwork they can concentrate on the big-picture projects, and that kind of thinking can drive growth.

Risks of Outsourcing Your AP Department

It’s not all sunshine and rainbows — AP outsourcing has its downsides too.

Sometimes, working with an external service could mean services aren’t consistently high-quality.

Handing over sensitive financial data raises the stakes as well. Security needs to be watertight, so nothing confidential slips through the cracks.

So, while your business might have its cybersecurity locked down tight, ask yourself: Is your outsourcing partner just as vigilant?

Lastly, accounts payable outsourcing means giving up a bit of control. It might take longer to make changes or decisions if someone else is running part of the show now.

Balancing shouldering these risks against saving costs and tapping into external know-how is key for any AP department considering this move. Outsourced accounts payable might streamline operations, but only if done with careful oversight.

AP Automation

Automation brings together the best parts of getting things done quickly and keeping a tight rein on operations, all while watching the budget.

What makes automation stand out is its knack for making accounts payable processes, right from handling invoices to carrying out payments, run smoothly and swiftly.

The Case for Automation

Boosting Efficiency and Saving Money: There’s a compelling reason why automation is getting attention, it completely transforms work efficiency.

When companies automate AP with best-in-class software, they see costs plummet by 80% and achieve 90% touchless invoice processing.

That’s no minor detail, given that they can reduce invoice resolution times by 80% and reduce the hours spent on vendor inquiries. The result is improved AP days, faster payments, and better vendor relationships.

Manual vs. Automated Processes: When we look at the traditional way of handling accounts payable, it’s easy to see how manual methods can bog things down. Think about matching invoices by hand, typing up each detail, checking for errors, and then walking through a step-by-step approval process that’s not just slow but also prone to mistakes.

Switch gears to automated processes though, and you have an entirely different story. Invoices land on an online platform through smart data capture with artificial intelligence to check for fraud and errors and match invoices.

Approvals don’t get stuck in a bottleneck, either. The system learns where to route invoices, which helps automated payments zip through quickly. Switching to a smart platform helps everything runs faster, cleaner, and fully compliant.

Visibility and Control: With AP automation, you get a clear picture and firm command over each step of the process. You have the ability to watch over transactions in real-time, tackle problems before they grow, and make choices backed by solid data.

When you choose an effective AP automation provider, companies become nimble in a way that outsourcing can’t provide. This means your accounts payable team works in harmony with your overall business objectives.

Embracing Efficiency: The Automation Advantage in Accounts Payable

While accounts payable outsourcing might help save money, it doesn’t quite match up to what automation brings to the table.

With AP automation, you gain more control and processes run securely and smoothly. You can speed up the entire procure-to-pay process while also cutting down on mistakes. Not only that, it lets you see exactly what’s happening in real time so you can make smart choices quickly.

Moving towards automation fits right in with what today’s businesses are trying to achieve — it turns AP from resource-intensive into a part of your business that adds value.