Despite being a known hazard to vendor relationships globally, delayed payments occur with alarming regularity. In Europe, the US, and the UK, 52% of procurement leaders surveyed admit to paying vendors late – averaging a 22-day delay. Additionally, 21% settle bills a month or more behind schedule.

Source: Procurement Magazine

Prompt payments come with many advantages; they give vendors the funds required to meet operational needs, which in turn supports the production of goods or services for you. Improved payment efficiency and vendor relations also help you negotiate better early-payment discounts. On the flip side, delayed payments disrupt the financial stability of vendors, which could lead to worse payment terms and strained relationships.

Governments are also stepping in to encourage good payment practices. New Zealand and the UK, for instance, enforce payment practice disclosures to enhance accountability and promote punctual payments. You can view an on-demand webinar on 2024 UK Payment Practice performance here.

What is the AP Days Formula (DPO Formula)?

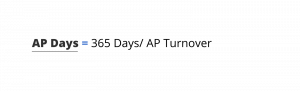

Accounts Payable Days is a ratio that measures the average number of days that it takes for your organization to pay invoices. AP Days is also known as Days Payable Outstanding.

You can calculate this number by, first, calculating the Accounts Payable Turnover with this formula:

Then, use this formula:

Here’s another way to perform your days in AP calculation:

Example of AP Days Calculation

Suppose your total vendor purchases are $15 million for 2023. Meanwhile, the beginning AP balance on Jan 1 was $1 million and the ending AP balance as of Dec 31 is $2 million.

You can solve for this using the formula for payable days.

AP Turnover = $15 million ÷ [($1 million + 2 million) ÷ 2]

= 10

AP Days = 365 Days / 10

= 36.5 Days

Based on the example above, it takes 36.5 days to pay suppliers. Although efficient DPO numbers can vary, your AP days should match your payment terms and be on par with the industry averages.

What AP Days Means for Your Business

While there are other key performance indicators to track, accounts payable days make it easier to assess the effectiveness of your accounts payable department. Knowing your DPO can also be a key input empowering you to ask for better terms, such as reduced prices or longer credit terms.

On the surface, it might seem like longer AP days could be beneficial because you’re keeping more cash on hand. A higher DPO than the industry average may even indicate better negotiating power, like when vendors are willing to extend you better credit terms than to your competitors. At the same time, it could suggest liquidity issues – since longer AP days could indicate that you’re not paying your obligations on time.

On the other hand, a low DPO often reflects high efficiency in delivering payments to businesses. You might even be paying vendors early to take advantage of early pay discounts.

Compare your AP days with similar businesses to establish a benchmark. You want to be in control of your AP days, which factors into your cash flow.

Factors Affecting AP Days

Here are the biggest factors that influence your AP days.

Efficiency of Workflows

Your AP days reflect how efficient your AP workflows are. Longer AP days may indicate poor, inefficient workflows, especially if you have enough funds to cover payments, but your obligations are past due. Perhaps you rely on manual processes to match and approve invoices, with many exceptions raised along the way.

Supplier Relationships and Payment Terms

Payment terms negotiated with vendors will affect AP days. Suppose you negotiate a 45-day term instead of the standard term of 30 days from a vendor, then your AP days might be longer than others since you have 15 more days before the payment becomes due.

Company Liquidity

Some businesses have longer AP days because they have cash flow issues. Liquidity pressure may force some companies to put off payments until they have enough funds to cover the obligation. Companies with long AP days and past-due obligations are likely to have funding issues.

How to Improve AP Days with Automation

Payment delays come with consequences from late payment fees to strained vendor relationships. Automation can be the key to reducing payment delays. 98% of companies expect AP automation to speed up the payment process.

Streamline approval to payment cycle

Data entry errors are among the biggest pain points in managing vendor payments. Some firms take as much as 17 hours a week correcting mistakes and managing payments. Automation can reduce errors while cutting staff time dedicated to monitoring expenses.

Provide informed insights to optimize cash flows

In the UK, 58% have disconnected finance and procurement functions while 35% lack payment visibility. With automation, 90% of companies expect automation to improve visibility and control over spending — making it easier to see what payments are due and to stay on top of all expenses.

Shorten AP Days with Automation

Accounts Payable automation removes the manual work in the invoice processing workflow, resulting in shorter AP days without increasing headcount or sacrificing data quality. By streamlining account payable processes, you can boost productivity to increase the effectiveness of your AP team.

Calculating your AP days and figuring out an optimal number will help you improve cash flow management. However, the capacity to efficiently process invoices and make payments is more important than the magic AP number. Staying in control of your AP process so that you can manage your payment cycles is a cornerstone benefit of AP automation.