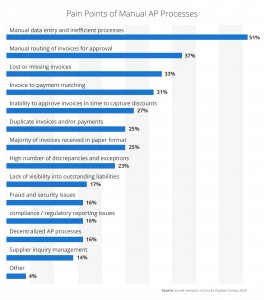

According to Levvel Research’s Payables Insight Report, an invoice approval workflow that relies on manual routing of invoices ranks as one of the biggest challenges in accounts payable – and is more common among organizations that have yet to embrace accounts payable automation.

AP teams that have yet to make the switch to automation will be all too familiar with the struggles that a manual invoice approval process brings. Missing invoices, unanswered emails, and payment delays are just some of those challenges.

In this blog, we will take a closer look at the challenges for AP teams with manual invoice processing before outlining the elements of an effective automated invoice approval workflow that you need to consider when researching solutions to automate your AP processes.

Challenges with Manual Invoice Approval

As mentioned, one of the biggest challenges with a manual invoice processing workflow is the sheer number of paper-based invoices involved. With more AP teams working remotely than before, the need to print, sign and scan large amounts of invoices at each stage of the approval workflow has become nearly impossible to manage.

The more paper-based invoices that need to be sent for approval, the slower the overall process is likely to be. This can result in late payments, which both negatively affect your organization’s cash flow but can also damage vendor relations. If you do not pay your invoices on time, you may lose preferred status with certain vendors. As a result, when it comes time to negotiate, improving contract terms becomes practically impossible.

Further issues arise when a payment is delayed without communication regarding the reason, as the vendor may conclude that the invoice has gone missing. In some cases, the same invoice will be sent again, potentially resulting in a duplicate payment being made. In a manual environment, AP teams struggle to spot such duplications, considering the sheer number of invoices that they are dealing with.

Manual invoice approval processes clearly leave organizations exposed to many issues that can prove both costly and time-consuming. Organizations need to embrace technology and look to automate their AP process and enable invoice workflow automation. When choosing an AP solution, there are some important features that will enable you to maximize the effectiveness of an automated invoice approval workflow.

Elements of an Effective Invoice Approval Workflow

1. Centralized Mailbox

Having a centralized mailbox for incoming vendor invoices is vital to the success of any automated invoice approval workflow. With your invoices arriving all in one place, the portal can then be configured efficiently. Invoices are routed to the relevant approver based on information provided in the invoice, such as product, department or amount.

2. Submission Requirements

Strict rules should be set for your vendors for invoice submission. For example, invoice number, PO number, where to send the payment to, and payment terms should always be included. If key information is missing, the invoice may need to be queried and even sent back to the vendor, adding a delay to the payment.

3. Set Due Dates

All invoices submitted for approval should include payment terms that detail when the payment is due. A clear deadline keeps invoice approval workflow functioning as efficiently as possible, preventing late payments and giving your organization the chance to maximize early payment discounts.

4. Assigned Approvers

After setting specific criteria for both invoice submission and invoice approval, the most relevant people need to be included in the approval process. If you decide that certain purchases or certain departments require multiple approval levels, make sure to define who the responsible person or party is for approving at each level.

An automated approval workflow will then ensure that as an invoice is approved at one level, it will automatically be routed to the next approver within the chain before it is declared ready for payment. Even if someone within the workflow is absent, the workflow can be configured to re-route the invoice to another assigned approver so that any delays are prevented.

5. Automatic Notifications and Reminders

An important feature of an automated invoice approval workflow is automatic notifications and reminders. When an invoice is routed to a designated approver, they will immediately be sent a notification asking them to action the invoice. They can then approve the invoice via email or log into the AP system to do so. This ensures that the invoice approval workflow keeps moving. If the invoice is not actioned immediately, reminders will be sent at configurable intervals in order to reduce further delays in the process.

6. Record Activity

With each step of the approval process logged, you have a full audit trail that reduces the time to conduct internal audits and investigations. This also ensures regulatory compliance requirements are met.

Conclusion

Invoice approval processes in the past have been both slow and disjointed, but it does not have to remain this way. According to a recent report by Levvel Research, some of the biggest benefits seen by organizations since automating their approval process through an AP solution include quicker approval of invoices, reduced errors, increased employee productivity, and lower processing costs. By making the switch to automation, you too can transform your invoice approval workflow and begin to experience these benefits and more.