The workplace as we once knew it has changed utterly. Lockdowns, quarantines and self-imposed isolation implemented during the pandemic moved millions of people around the world to working from home and accelerated remote working to the mainstream. Even with some safety measures easing up, employees overwhelmingly hope to sustain a remote-friendly work environment with 94% of people saying they would like to work remotely at least some of the time. If you are still managing your finance team in the same way you did prior to this move to remote working, you need to re-evaluate.

In this blog we look at some steps businesses can take to manage and support a decentralized finance team.

Provide Flexibility

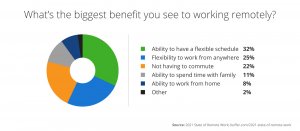

Embracing remote work provides benefits such as lower overhead costs and more productive employees. According to this article by Bloomberg, the work-from-home boom will lift productivity in the U.S. economy by 5%, mostly because of savings in commuting time. Given these advantages, many companies have continued their shift towards a fully-remote setup or a hybrid work arrangement with remote and in-office options. After the pandemic, employees may be able to work from home about 20% of the time, compared to 5% pre-pandemic.

Companies are also under pressure to enable remote work for business continuity in case of another pandemic flare up and to address problems with talent retention. Aetna International’s global survey revealed that 51% of employees believe companies need to improve flexible working arrangements to attract more talent. For the next generation, remote working looks likely to become a standard expectation. Almost 70% of Millennials and 64% of Generation Z said the option of working from home in the future could relieve stress, according to the latest edition of Deloitte Global Millennial Survey .

The other side of the coin, however, is that unplugging from work becomes much harder with remote work. Responsibilities have also increased for workers, following coronavirus-related layoffs and labor shortages, with about 30% of employees feeling crushing pressure from a fuller workload.

Recognizing boundaries within remote work and giving your team the flexibility to take care of their needs, whether it be childcare or mental health, will make remote working more sustainable.

Improve Collaboration and Communication

Difficulties with collaboration and communication remain a top struggle for remote workers.

Some of this can be addressed using routine virtual meetings, where teammates check in on progress and challenges. This creates opportunities to cultivate personal and social bonds, enabling your virtual finance team to build the connections that make teams effective.

Outside of virtual meetings, collaboration often moves to a universally accepted yet still problematic system: email. While it’s theoretically possible to reach the teammates you need, data can get lost in the email shuffle and ultimately kill productivity. Overflowing inboxes and incoming messages is the biggest distraction for 30% of remote workers.

Real-time messaging channels have also been added to the mix. However, keeping up with multiple threads on the same topic in different places makes it easy to miss key information. AP teams risk having to deal with major errors as well as only having partial visibility over the approval workflow. The fix? An accessible, cloud-based, and unified secure platform where every element of the AP process is managed.

Focus on Security

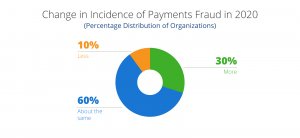

81% of firms last year were targets of payment fraud, in part due to the rushed deployment of hardware and software to sustain operations. The speed of change resulted in fewer opportunities to integrate security workflows into new systems.

As the dust settles on the rush to maintain technology infrastructure, the new challenge lies in threat detection and monitoring systems to reduce opportunities for fraud.

Source – JP Morgan

According to a JP Morgan survey, 30% of corporates reported an increase in payment fraud in 2020. Companies more likely to see an uptick in fraud occurrences are those with reported annual revenues of at least $1 billion with 100 or more payment accounts.

Investing in smart AP technology allows businesses to strengthen controls over procurement and payment processes. AP automation removes the reliance on less secure systems like emails or messaging systems. Vendor management also enables additional security features such as ensuring any Vendor Master Data changes are centralized with a clear audit trail.

Increase Productivity Within Finance Teams

Despite widespread digitization, a McKinsey survey revealed that only 13% of finance teams use artificial intelligence and robotic process automation. Moreover, in the past year, 64% of organizations digitized less than a quarter of the finance function.

The slow uptake comes primarily from a lack of clarity of automation opportunities. Some companies still opt to perform inefficient and manual processes outside the system due to cost constraints and difficulty with existing platforms. For instance, less than 30% of SAP ERP users automate procure-to-pay systems, compromising visibility over the entire process.

Upgrading automation has clear benefits. Investing in technology improvements such as a third-party procure-to-pay integration can increase productivity by as much as 86%. Supporting remote approvals eliminates the need for human intervention. Finance teams can use time freed up to generate strategic value for the business.

Update and Reinforce Policies

With a fluid work environment in place, it might be time to rip up parts of the employee handbook and start afresh. To support the transition, remote work requires updating policies in areas ranging from tech and security to appropriate video conferencing behavior.

The first step is to define a remote work policy. Who is allowed to work remotely and when, and how do you define productivity? Policies may need to factor in workplace regulations and legal pitfalls like work environment obligations.

Ensuring workflows go through compliant procedures can also be a challenge. Deploying automated systems is one method to ensure policies are up-to-date without adding additional work for your remote team. Built-in controls provide a clear audit trail complete with time stamps and employees in-charge — eliminating the need to dig through a mountain of files to address auditor inquiries. Integration also allows cross-checking between departments to detect non-compliant transactions.

Mobilize Tools for Better Visibility

Given more sophisticated technology, companies can put 68% of underused data to use. AP automation supports finance teams in the shift from a transactional to an analytical team.

Tracking cost trends using information from AP departments allow companies to prioritize cost categories, identify opportunities, and enable benchmarking against other competitors in the industry. Companies can leverage analytics to fine-tune spend control with real-time visibility, resulting in more effective forecasting, budgeting, and cost-cutting initiatives.

Performance metrics and KPIs gained through spend data are also valuable tools in negotiating with key suppliers and providing insights to maximize ROI.

Conclusion

By 2028 an estimated 70% of teams will have remote workers — making it necessary to have the infrastructure to support virtual work. Remote teams promote better talent retention by offering employees greater flexibility to manage their personal and professional lives. If this is not a journey you have started for your organization it needs to be an urgent area of focus for 2022.

Managing remote finance teams requires deliberate preparation and automation to achieve efficient collaboration, maintain security, and support productivity. If you would like to hear more about how SoftCoAP can help, please schedule a Demo today.