Is your organization getting all of the early payment discounts that it can? If so, you’re among only 33 percent of organizations who are, according to a Levvel Research survey.

If not, you need to consider using accounts payable automation software. Benefits to using modern accounts payable solutions include accelerating the invoice lifecycle, capturing early pay discounts, and providing savings of thousands, or even millions, depending on the size of your organization.

Our experience working with over 1 million procurement and accounts payable professionals has shown that there are five simple ways to ensure you become one of the 33% who always captures early payment discounts.

Secrets to Capturing Early Payment Discounts

Centralize Invoice Receipt

If not already in place, develop a formal policy that requires all invoices to be sent immediately to the AP department, and make suppliers aware of this policy as well. Clear policies prevent invoices from being held by the purchasing department or field approvers until after the discount opportunity has passed.

Procurement and AP Alignment

One of the most effective ways to see higher early payment discount capture rates is to align your procurement and AP teams. Successfully working together, from the discount negotiation process to facilitation, requires effective communication.

AP can also have a hand in sourcing, a task normally left to procurement, by fuelling the process with insights into the budget and input on matters regarding the suppliers’ accounting team. Procurement and AP are also a great pair when it comes to spend analytics, as both have a part to play in ordering, approving, and making payments.

In order to make this partnership work, both teams are encouraged to develop common goals and find a way to track progress together. As with any team, a focus on culture and team building will keep the collaboration healthy and beneficial to both.

Perfect Invoice Data Capture Process

There are a variety of ways that invoice data can be captured and entered into a finance system. The effectiveness of your process depends on determining which system works best for your organization based on a number of factors:

- How many invoices do you receive? If it is a low volume, then manually keying in the information may be a cost-effective solution for you. However, if you have a high number of invoices, it may be more effective from both a time and money standpoint to outsource the data capture process.

- What is the format of the invoices you receive? Electronic invoices are preferable, as they allow for the transfer of documents in a standard format. Paper format or PDF will require either manual keying or scanning so that they can be read by Optical Character Recognition (OCR) software, either in-house or from an outsourced partner.

- Finally, you should consider the type and amount of data you need to extract. Invoices with few line items can be keyed in manually. However, if there is a lot of necessary information on the invoice, OCR may be the most accurate way to capture it.

Automate Invoice Matching

Automated three-way matching is a way that organizations match a large number of their invoices. It acts as a “handover” from procurement to AP, matching line item data from the purchase order, the goods received note, and the invoice. Automating the matching of line item data allows the invoice to move through the AP process without any information needing to be manually entered or checked. This saves time for AP staff and prevents errors.

Automate the Invoice Approval Process

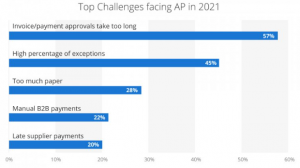

According to a recent report, the top challenge for AP professionals lies with invoice and payment approval taking too long.

Slow processing times not only are an unwise use of employee resources with increased risk of human error from manual input, but also make you miss out on early pay discounts.

Thankfully, AP teams can automate their approval process. Once decided, approval routes are configured into your finance system to determine the path that an invoice needs to follow to become verified and approved. Leading finance platforms even offer the ability to verify and approve an invoice with one click from a mobile device, using email.

Conclusion

Through the optimization of key accounts payable processes such as the ones listed above, you’re not only on your way to capturing early payment discounts, but you also avoid late payments and penalty fees that arise through slow and inaccurate manual processes. You also achieve better compliance with regulatory requirements and improved visibility over liabilities.

Considering that two-thirds of AP staff spend 1-8 hours a week resolving AP issues, such as tracking down paper invoices, an increase in employee productivity is also another bonus to optimizing the AP processes. In fact, optimizing the process allows many organizations to restructure their AP staff, reallocating staff from low-value tasks such as manual entry to more strategic positions. This places a higher value on the amount that the organization is spending on labor.

Optimization allows your business to improve discount capture rate, reduce exceptions, and provide AP teams with the necessary support to become strategic departments — and SoftCo AP automation is the key to unlocking these benefits. Schedule a demo to learn more.