For many organizations, accounts payable is almost an afterthought. Some companies with yearly revenues of up to $10 million may not even have a dedicated accounts payable department, instead delegating all accounts payable duties to a member of their office team.

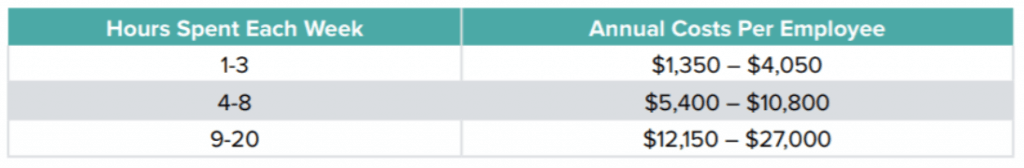

However, for most companies that do more than around $5 million per year in revenues, a dedicated accounts payable person or team becomes a necessity. Even for smaller companies, processing invoices, goods receipt notes and purchase orders can easily take 20 or more person-hours each week. Manual invoice processing inevitably leads to issues. Levvel Research reports that these issues alone can cost organizations up to 20 person-hours each week, with the resultant weekly costs in the thousands.

This means that nearly every company that is currently using manual accounts payable processes can realize large benefits from incorporating AP automation software into their systems.

So, how does a business know if they are ready to make the leap from manual processing to AP automation software? In a recent blog, we discussed the key steps to delivering the best AP solution for your organization, however, there are a few things to consider in order to ensure your organization is ready to begin carrying out these steps. Let’s take a look at a few signs that suggest your company is prepared to implement an AP automation software solution.

You are aware of the biggest inefficiencies in your accounts payable processes

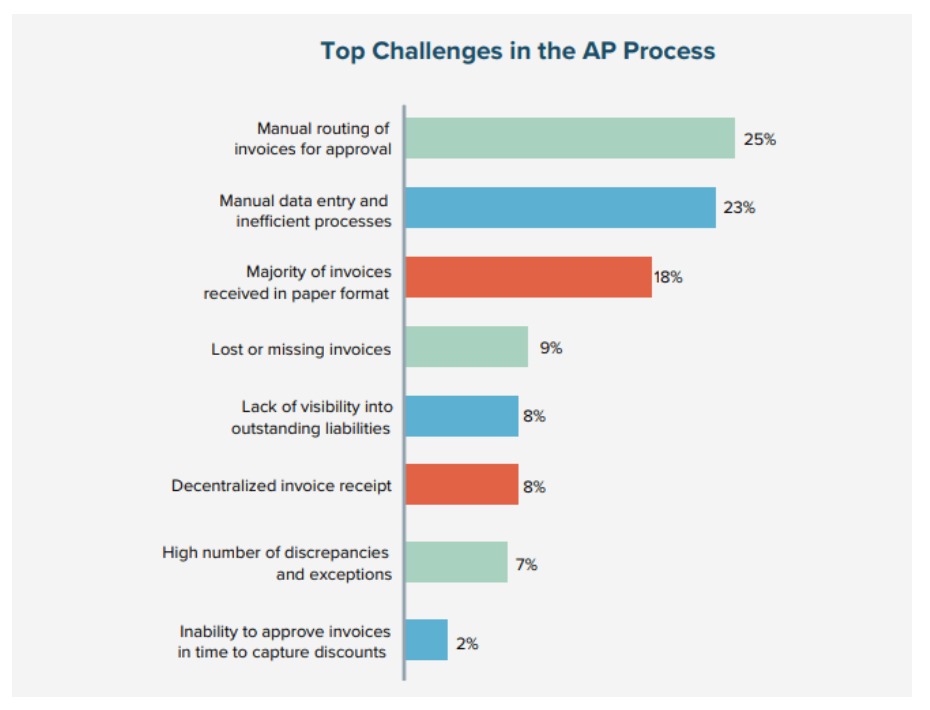

According to Levvel Research’s Guide to Leveraging AP Automation, one of the largest and costliest pain points that organizations experience in their accounts payable operations involve manual entry of data and inefficient within the area of invoice processing.

Other major pain points that can lead to dramatically elevated costs include manually routing all invoices for approval, receiving most invoices in paper format and receiving invoices in a haphazard or decentralized fashion.

Other less common but potentially serious problems that many companies struggle with are such things as lost or missing invoices, high rates of errors and missing invoice discounts due to late processing.

You have surveyed your invoice processes and know your company’s data

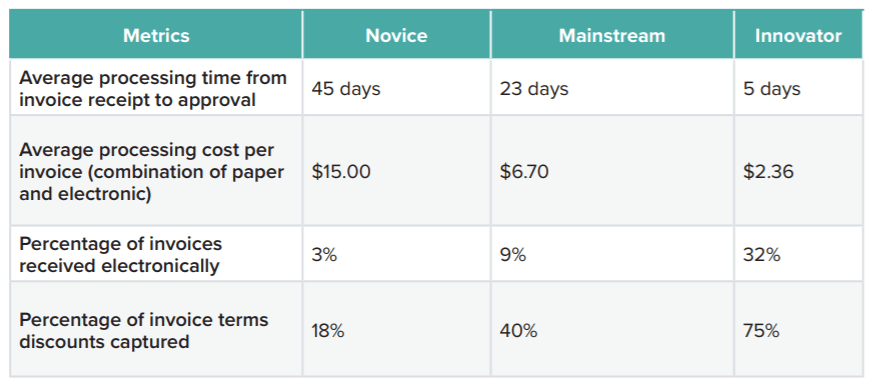

Two of the biggest things to look for is how much your company is spending on processing each invoice and how many total invoices you are processing. Other metrics to consider include the average processing time from invoice receipt to approval as well as the percentage of your total invoices that are being electronically received and the percentage of discounts that are being captured.

Generally speaking, if your company is seeing per-invoice processing costs in excess of $10 or processing times that exceed 30 days, then your company stands to benefit immensely from adopting an AP automation software solution. Additional indicators that AP automation software may dramatically improve the efficiency of your accounts payable operations include supplier-discount capture rates of less than about 40 percent and receiving less than 10 percent of all of your company’s invoices electronically.

You are aware of the benefits of AP automation software

In business, everything boils down to the saying that the bottom line is the bottom line. AP automation software is no different.

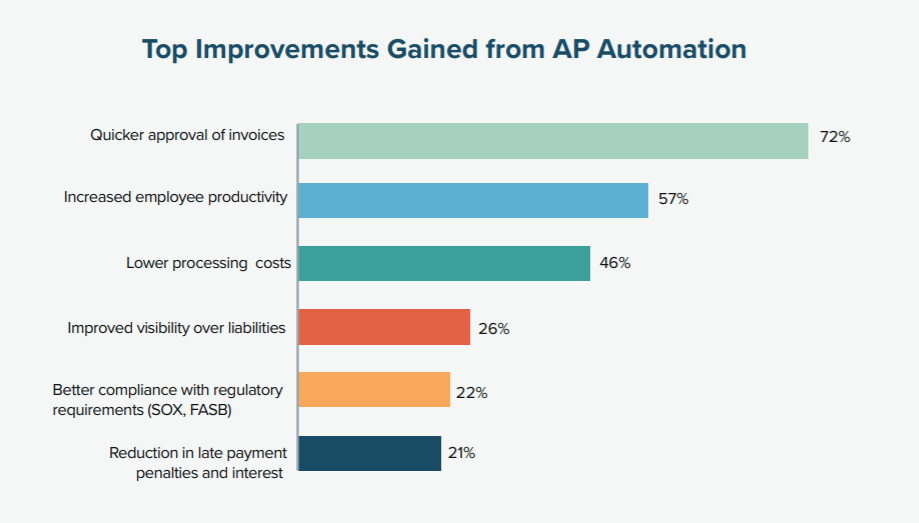

The single largest advantage of adopting accounts payable automation is the sheer amount of money it can save your business. Numerous studies have concluded that going from all-manual accounts payable processes to high-level automation can reduce costs dramatically, with non-automated departments spending an average of more than 6 times what their highly automated counterparts spend.

As reported in Levvel’s Guide to Understanding and Implementing Scalable AP, these savings are mostly realized through quicker approval of invoices, improved visibility of inefficiencies and liabilities, lower processing costs and capturing a far higher proportion of available discounts.

However, huge benefits can show up in subtler ways. Most companies that adopt even minimal automation of their accounts payable processes report significantly improved employee productivity, as employees are able to be redirected on more value-creating tasks. Further savings accrue from increased ability to comply with regulations as well as a sharp reduction in late fees and penalties.

You have identified systemic requirements for technology as well as human processes

One of the biggest objections that upper-level managers have in adopting a fully automated accounts payable system is that it is likely to cause unacceptable disruption to the company’s operations. Unfortunately, this turns out to be a well-founded concern in many cases. But the effects of implementing new AP automation software can be ameliorated through a piecewise approach to adopting this cost-saving technology.

Each company is different. It is always a good idea to work with an experienced consultant to determine what the most effective course of action is when it comes to adopting automated accounts payable systems.

The best course of action in adopting this software will usually involve going after the greatest pain point first. One of the easiest and most lucrative fixes involves making the switch from completely manual data capture to an OCR-based system. Another area where relatively seamless adoption of AP automation software is possible is in invoice routing, which can be resolved through setting up a portal for electronic invoice submissions by suppliers as well as implementing an invoice workflow tool.

You have consulted with your IT team

Once you have decided the scope of your accounts payable automation project, you may need to bring an individual or a group on board from your company’s IT team. This is an important step, especially if you will need to pitch your proposal to higher-ups. Having your company’s IT team on board, with a detailed roadmap as to how the transition will be made from manual processes to partial or full accounts payable automation, will go a long way towards reassuring superiors of the viability of the project.

Overcoming misplaced objections

If you are a C-level decision-maker, you may only need to convince yourself that potentially outright saving hundreds of thousands of dollars each year in processing costs while freeing up massive human capital to be redirected to more value-additive projects is the right move.

However, most readers may need to overcome roadblocks before moving their companies towards full accounts payable automation. The most common roadblock that you will encounter is your company simply not having budgeted for the up-front costs of adopting accounts payable automation. However, each dollar that is spent on implementation of AP automation software can potentially net double-digit returns every year, well into the foreseeable future.

The simple fact is that almost every company that has fully manual accounts payable processes can immediately and enormously benefit from implementing AP automation software. Moreover, these benefits, visible or not, often manifest in seven-figure increments on your company’s balance sheet.

For those interested in delving deeper into AP automation, we invite you to explore our complete guide to AP automation for a thorough understanding.