Preventing payment issues through verifying invoices and making accurate payments can be time-consuming and costly – leaving little time to focus on growth and innovation.

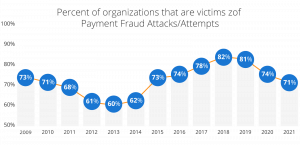

Source: AFP

The good news is that technology has come to the rescue. Automation allows businesses to improve the accuracy of payments without sacrificing speed.

In this post, we will discuss how payment automation solutions keep payment threats in check. But first, let’s go through 21st-century payment risks and what they are.

What is Payment Risk?

Payment risk refers to the possibility of payments being incomplete or inaccurate. Delayed payments, issuing payments with the incorrect amount, and sending payments to the wrong vendor are some of the most common payment risks. These risks may lead to a partial or total loss for one or both parties, penalties, and additional charges because of inaccurate transactions.

Use Intelligent technology to Detect Payment Anomalies

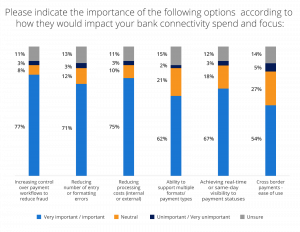

In 2022, 62% of large banking institutions reported an increase in financial crimes. As global economic growth slows and credit delinquency is likely to increase, experts expect more opportunities for fraud. 77% of companies believe increasing control over payment workflows to mitigate fraud is critical.

Source: Corpay

Businesses need a reliable way to detect unusual activity, and they are looking to technology to improve payment security. Deploying an automated payment system allows your business to have full visibility into every transaction across payment channels, increasing the ability to detect fraud.

Machine-learning algorithms within automation software can evolve over time – allowing your payment system to become more sophisticated in flagging unusual transactions. AI improves fraud detection and, at the same time, flags operational errors that may cause potential issues if left unresolved.

Enable Continuous Risk Management

Most companies have reactive payment controls that detect anomalies after the fact. As a result, companies can only deal with the aftermath and strengthen controls and policies, hoping to avoid the same issue from recurring. If these controls and policies rely on manual enforcement, their effectiveness is limited.

Automation makes nearly real-time monitoring possible so that your business can be more proactive in dealing with risks. By increasing the frequency of monitoring, companies can more effectively catch policy and security violations as well as exceptions. For example, machine learning may be able to detect patterns and trends to flag potentially risky payments. Full visibility into transactions provides a clear audit trail that keeps your payments team well-informed and ready to act.

Validate Business Payments

Robust payment verification is the key to minimizing payment errors and preventing fraud. Many businesses are accustomed to performing manual validation as part of internal controls. However as your company grows, manual checks may no longer be viable or cost-effective.

Automation creates built-in controls to validate payment transactions. For example, AI-powered automated payment solutions will compare the amount from approved expenses in your invoice management tool against disbursements for transmission to your bank and notify you if it finds any invalid data.

Performing this check enhances payment security, improves productivity, increases customer trust, and prevents fraud. At the same time, it creates a clear audit trail that supports compliance with existing payment regulations.

Reduce Manual Touch Points

In a manual workflow, streamlining processes can be challenging due to payment errors. Issues like incorrect payees or the wrong amount could delay payments. If the faulty transaction goes through, it would require extra work – you may have to reconcile accounts with vendors or issue another payment. On average, financial decision-makers spend about eight hours on problems like incorrect approvals, returns, and payment failures.

Automation reduces friction by reducing manual touchpoints. Modern payment solutions pull data from your ERP or AP automation tool to create payment files. Forwarding data automatically eliminates manual data entry and human error, which reduces potential problems with vendor payments. When data needs to pass verification and automated checks, AI further reduces the chances of making incorrect vendor payments. At the same time, it increases staff productivity because you can prepare payments to multiple recipients automatically.

Ensure Compliance with Regulations

Traditionally, compliance is a time-consuming and tedious process, especially for companies operating in multiple territories. A company’s compliance officer has to perform manual checks and transaction reviews for payment transactions. Automated payment processing systems make compliance more effective, efficient, and affordable by using systems tailored to existing regulations for a specific market or country.

Suppose you operate in multiple locations – you need to comply with the rules and regulations in the area where you operate. Local compliance requirements vary across different territories, so one branch may have to comply with more stringent regulations compared to another branch. Implementing the strictest level of compliance may seem like the ideal solution, but often it can have an adverse impact on your business.

While it may seem practical to implement compliance with the strictest regulations, it’s not always the best decision for staying competitive. You may not be able to make payments as quickly and seamlessly, which impacts transactions with vendors and customers.

Automation makes it possible for businesses operating in multiple territories to stay compliant with relevant regulations through built-in payment controls designed to meet the requirements of each country. Deploying smart technology ensures compliance while helping you stay competitive.

Mitigate Payment Risks With Smarter Systems

Payment channels have come a long way over the past decades. Businesses no longer need to rely on paper check payments – they can pay vendors electronically with lower costs. However, as payment methods evolve, so should your company’s payment automation system. It’s critical to have security measures in place to protect the company’s financial resources.

B2B payment automation software is designed to keep pace with the increasing complexity of payments and evolving security requirements. This provides the highest level of protection against evolving threats.

If you want stronger controls over payment processes, embrace automation to create a hassle-free but secure way to settle payables with vendors, employees, and other payees.