As energy costs have risen around the world, the demand for renewable clean energy has prompted heightened activity in the wind energy sector, creating added strain on procure-to-pay processes. Supporting growth requires streamlining processes to tackle the industry’s unique challenges.

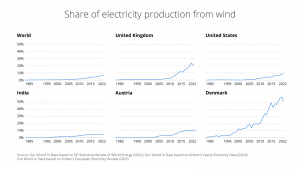

Bold targets to wean economies away from fossil fuels have significantly increased demand for wind and solar energy, which generated 12% of global electricity in 2022. Between the two, wind energy has higher efficiency at 50% compared to the 20% efficiency level for solar panels – making it an attractive energy source for residential and industrial use.

The wind energy sector has primarily grown due to the need to achieve sustainability targets and corporate responsibility goals, address risks from energy price fluctuations, comply with decarbonization regulations, access more affordable energy, and gain a competitive advantage. Governments around the world have passed legislation such as the REPowerEU in Europe and the USA’s Inflation Reduction Act to support renewable energy investments. In 2021, global investments in wind energy technologies reached roughly 147 billion U.S. dollars in 2021. In Europe alone, €41bn was invested in the construction of new wind farms.

Unfortunately, slowing global growth and persistent high costs squeeze margins from the wind energy sector. Automation is key to managing costs and boosting efficiency.

Accounts Payable Challenges for the Wind Industry

Renewable companies operate a vast number of wind farms in geographically dispersed locations based on potential energy generation. Each farm needs to be treated as a separate entity with costs tracked accordingly, which means that invoices received also need to be matched and allocated appropriately.

A company with 100 wind farms, for instance, may have 100 different entities scattered in various territories dealing in multiple currencies. Finance teams need to accurately allocate costs to the right entity, which helps to ensure that expenses stay within budget.

In a manual AP environment, validating and associating the right costs to the appropriate entity is heavily resource intensive. Obtaining real-time visibility and an accurate representation of accrued expenses is incredibly difficult. Due to the dispersed nature of each wind farm, compliance requirements also vary across each entity, adding to an already complicated AP process.

Digital innovation can ease the accounts payable workload using automation and analytics to speed up cost tracking and expense allocation across multiple entities. A pre-approved spend system simplifies the process further while implementing stronger internal controls over expenses across all stages of operating wind farms – from development to decommissioning.

How to Manage Wind Farm Costs with Automation

Wind farm projects can be divided into four key stages – Development, Construction, Maintenance, and Decommissioning. Through each stage, wind power companies deal with a variety of vendors and incur significant costs that need to be tightly controlled and managed.

- Development. Screening, feasibility, and development fall under the development stage. Under this stage, companies incur and have to track expenses related to preliminary surveys, wind resource potential, potential risks and obstacles to development, and the physical and environmental characteristics of the site.

- Construction. Wind farm construction starts after establishing site feasibility and securing the necessary permits. The average wind farm has 50 turbines that each cost in the $2-4 million dollar range. Other construction expenses can include electrical infrastructure, engineering and management, site access and staging, and tower construction.

- Maintenance. Operation and maintenance costs include regular maintenance and repairs site monitoring, and operational expenses like transmission and interconnection costs, land lease or rental fees, and insurance and taxes.

- Decommissioning. Wind turbines have an estimated life of 20 to 25 years. After this period, most governments require wind farm operators to remove turbines and restore the site to an environmentally sound state.

Set Pre-Approved Spend Limits

An intelligent accounts payable automation solution streamlines cost control and approval across multiple wind farm entities. Each category and entity can be set up with a pre-approved spend budget for the entire construction project.

For example, after identifying a turbine manufacturer and forming an agreement for project costs, the AP team can create spending budgets. Selected users will have authority to draw-down on pre-approved spends only for specific vendors. As a result, every project is tracked and evaluated by category against the original agreed budget and forecasted spend – within any entity.

Budget monitoring is achieved in real-time with complete visibility into how much has been spent, the accruals, and how much is left. As each budget is drawn down, costs are automatically allocated to the correct GL code, cost center, and entity. Advanced analytics supports a deep dive into data to understand cost patterns and increase cost efficiency.

Efficiently Process Invoices for Multiple Entities

While pre-approved spending budgets are drawn down, a purchase order is also generated and issued to the vendor. After vendor invoices are received, they are auto-matched and reconciled with the PO. If a Goods Receipt Note(GRN) has been setup then they are 3-way auto-matched. With the right AP automation solution, wind power companies can achieve up to 90% straight-thru invoice processing.

Consolidate Vendor Management

Each wind farm may have its own set of approved vendors for expenses like site foundations, cabling, site construction, turbine vendor, materials, grid connection costs, logistics, and transmission lines.

Investing in a vendor management solution improves relationships by creating a positive experience for supply chain partners from onboarding to invoice approval. Effective vendor management includes a dedicated vendor portal to manage all vendor communication, allow secure and quick invoice submission and status tracking, and send queries and disputes to resolve discrepancies faster.

Faster dispute resolution reduces time spent processing invoices, allowing organizations to make payments on time and unlock cost savings through early payment discounts.

Automate Payment

Payment issues with vendors could arise on critical services like site maintenance, repairs, monitoring, land lease, rental fees, transmission and interconnection costs. Not paying vendors on time puts wind turbine operations at risk, because they will simply stop.

A 4MW turbine generates the equivalent of $700k in power per annum, and having even one turbine out of order for a week due to an accounts payable related issue results in significant loss of power. Payment automation reduces payment risks with a centralized, secure channel for all payments, delivering control and transparency.

Improve Cost Matching and Monitoring with P2P Automation

Energy companies using manual accounts payable processes struggle with monitoring entities and projects that each have their own budget, approved vendors, and applicable regulatory requirements, while dealing in multiple currencies. Staying on track with a complex structure while maintaining cost visibility across territories requires AP automation.

Opportunities and challenges lie ahead for the wind energy market. Overcoming economic headwinds and cost pressures requires strategic partnerships with vendors, optimized procurement, and streamlined systems.

Successful application of digital technology in the energy industry can result in a 10 to 30% improvement in cost efficiency, which impacts long-term business survival and competitiveness.

Achieving efficiency through AP automation will allow the wind power industry to overcome value leakage and manage significant project risks from price instability and cost inflation.