Organizations are increasingly adopting AP automation to streamline processes and reduce costs. In 2024, look for a focus on vendor cost management, AI and machine learning, regulatory requirements, and seamless payments.

Gartner forecasts that spending on the accounts payable automation and supplier e-invoicing software market will approach $1.75 billion by 2026, up from $1.1 billion in 2023, with a growth rate of 14% CAGR. By 2025, half of all B2B invoices may be processed and paid without manual intervention.

Amidst this growth momentum, let’s look at five AP trends for 2024.

5 AP Automation Trends in 2024

1. Maximizing Resources and Prioritizing Vendor Spend Management

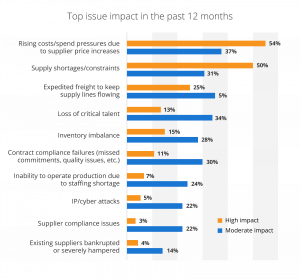

Under a relatively high-interest rate environment and uncertainty about the global economy, CFOs and finance teams are facing increasing pressure to cut costs. To make matters worse, 47% of CFOs expect operational costs to increase – a jump of 17 percentage points from Q2 2023. Rising cost pressures from supplier price increases continue to have a moderate or high impact on a majority of Chief Procurement Officers.

With cost reduction top of mind, a stunning 92% of employers say they anticipate downsizing in 2024 — even after 96% of organizations took downsizing action in 2023. Lowering headcount increases the responsibilities of lean teams.

AP automation supports efficient operations even with staff shortages and limited resources. The technology significantly lowers the processing cost per invoice by automating routine tasks, freeing up time and resources for finance teams so they can focus on higher-value activities.

In addition, AP automation provides 100% real-time visibility into vendor spending, offering valuable insights and data-driven analysis. This empowers businesses to make informed decisions about vendor relationships, identify cost-reduction opportunities, and optimize vendor spend.

In a Q3 2023 CFO survey for the third straight quarter, managing vendor costs was ranked as the top area for potential cost reductions. AP automation directly addresses this opportunity to optimize vendor relationships and adapt to pressures on business margins.

2. Harnessing AI

It’s only been about a year since ChatGPT burst onto the scene, but organizations have been keen to evaluate how artificial intelligence can boost productivity. Executives expect 2024 to be another watershed year for AI. 56% of C-suite leaders prioritize the use of AI in areas with an immediate impact either on cost or revenue.

Coupled with machine learning, artificial intelligence further streamlines accounts payable processes in areas like:

-

- Enhanced data accuracy: AI tackles correcting optical character recognition (OCR) errors with precision and can extract information more accurately with natural language processing (NLP), regardless of format or complexity.

- Intelligent invoice matching: By going beyond simple rules-based algorithms, AI and machine learning can match invoices without purchase orders or with missing details details. While providing more accurate invoice processing, intelligent systems can also provide a level of confidence in their accuracy.

- Automating smart routing and coding: Invoices can be automatically routed to the appropriate approvers and assigned coding.

- Fraudulent and duplicate invoice detection: AI excels at identifying anomalies in vendor behavior, flagging suspicious inconsistencies to safeguard financial resources.

3. Data Enrichment

Data enrichment strategies include combining your internal data (first-party data) with external sources (third-party data) for additional information and data verification. Enriching received data with reliable sources supplements data gathering and improves accuracy.

In accounts payable, data enrichment can improve outcomes in:

- Invoice matching: Invoices often arrive with missing or incomplete information. Adding verified data like product or vendor codes improves the accuracy of automatic matching and reduces the need for manual intervention.

- Smart coding: Assigning relevant account, industry, or project codes assists cost allocation along with insight and forecasting accuracy.

- Reports and analytics: Enriched data may offer more comprehensive information for reports that measure vendor performance. For example, if you have multiple vendors that are subsidiaries of the same parent company, appending vendor data with parent company information supports analyzing total spending and exposure to that corporate entity.

- Vendor verification: External sources like government databases can verify vendor information and tax codes, lowering the probability of dealing with fraudulent businesses.

- Visibility: Shipping or logistic details may be added to enrich the data set, enhancing transparency. Enriched data generally reduces the need for manual verification.

4. Evolving E-Invoice Clearance Requirements

More than 100 countries already mandate some form of electronic invoicing to streamline tax collection, primarily with business-to-government (B2G) transactions. The challenge has been trying to set universal standards because of divergent regulatory frameworks. Invoice requirements and processes can vary – for example, post-audit, where invoices are audited after the fact, is more common in the EU, whereas real-time invoice clearance is more common in Latin America.

According to Gartner, organizations might expect more countries to shift to an invoice clearance model, where invoices need to be presented to the government in real time. Essentially, electronic invoices must be verified and approved by a central government agency before they are sent to the recipient.

For example, in France, B2G transactions have required invoice clearance for several years. In 2022 a law mandated e-invoicing clearance and e-reporting for B2B transactions by July 1, 2024, though the implementation date has since been postponed to September 2026. Invoice clearance minimizes the loss of tax revenue by supporting tracking and accountability.

5. Demand for Seamless, Secure Payment Methods

Payment fraud continues to be a growing concern, as 70% of financial institutions report increased fraud rates in 2023 across payment methods. A reliance on manual payment processes further opens the door for fraudulent activity. However, nearly 70% of companies surveyed still use phone calls to validate vendor bank account information, which is not only time-consuming but prone to risk and error.

Payment automation allows faster invoice matching, improves transparency in B2B payments, and supports automatic account reconciliation. Having a single workflow that’s easy to monitor for fraudulent activity can help you increase confidence in payments and improve visibility. Reducing the complexity of your payment workflow has the added benefit of speeding up payments, offering visibility into your expenses, and reducing payment transaction fees.

Navigate The Year Ahead with P2P Automation

As the push towards digital transformation continues, one thing is clear: companies that focus on AI-powered finance automation can unlock cost savings and foster strategic growth. The integrated approach of end-to-end P2P automation simplifies workflows, reduces costs, enhances accuracy, speeds up payments, and benefits vendor relationships.