Accounts Payable automation transforms organizations by eliminating manual tasks, providing real-time visibility into cash flow, and enabling employees to focus on more strategic, value-added work. The benefits of AP automation ripple throughout organizations, empowering executives and staff to significantly boost productivity and efficiency. In this blog, we take a closer look at how AP automation impacts each role.

AP and Finance Teams

For AP and finance teams, Accounts Payable automation delivers significant time and cost savings by streamlining workflows and removing manual work. On average, automation saves AP departments 9.9 hours per week – freeing up 500 hours annually for more impactful initiatives.

Reduce Manual Work, Streamline Workflows

Automation eliminates manual data entry and paperwork, allowing AP staff to manage invoices with a few clicks. Touchless processing enables instant approvals, identifying discrepancies automatically. Teams can handle more invoices and scale operations more easily.

Gain Complete Visibility

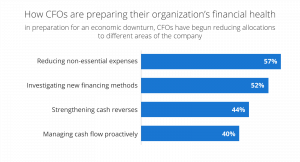

Real-time reporting provides transparency into cash flow – enabling data-driven decisions and more accurate forecasting. Dashboard analytics deliver insights to spot inefficiencies, identify savings opportunities, and plan more effectively. With three-quarters of finance leaders worried about an economic downturn and preserving financial health, cash flow management is as important as ever.

Source: CFO News

Speeds Up Month-End Year-End Accounting Close

By automatically reconciling invoices and payments, AP automation accelerates month-end and year-end closing of books. Finance teams have real-time insight into open invoices, payables, and spend by department to quickly produce financial statements.

Combat Increasing Turnover, Burnout

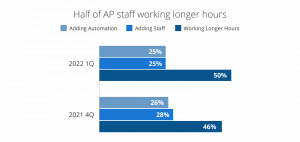

Source: IOFM

Today’s unprecedented turnover and burnout puts AP teams at risk. 50% of AP teams report working longer hours, and half say they are considering leaving their jobs. AP Automation provides relief by eliminating tedious tasks.

Increase Time Spent on Strategic Work

With automation handling routine transactions, AP staff can focus effort on value-added initiatives like process improvements, spend analysis, negotiations, and long-term planning. Rather than just processing invoices, AP teams can evolve to become integral assets to an organization’s financial planning strategy.

CFOs and Controllers

CFOs and controllers seek the operational efficiency, real-time visibility, and cost control delivered by AP automation.

Significant Cost Savings

Automation streamlines invoice processing, preventing late fees, eliminating paper and postage, and reducing labor required. According to Ardent Partners, Accounts Payable automation delivers nearly a 50% cost reduction in invoice processing.

Data Accuracy, Risk Mitigation

By extracting invoice data digitally instead of manually entering it, automation minimizes errors that lead to problems like duplicate payments. Multi-point invoice audits also catch errors in real-time during processing, supporting strong internal controls and helping reduce invoice fraud.

Streamlining Audit Compliance

A fully automated digital audit trail makes audit compliance easier. For starters, electronic storage of validated invoices simplifies the gathering of materials for audits and tax filings. Reporting tools also create custom views to demonstrate compliance without having to dig through paper files looking for data.

Complete Visibility

Real-time dashboards can connect directly to the general ledger, enabling CFOs and controllers to view past, present, and future cash commitments in detail.

Turning AP into a Profit Center

Modern AP automation systems do more than just process invoices. Rich data analytics help uncover savings opportunities within spending, evaluate vendor performance, and creatine company-wide efficiency gains and cost reduction. This data helps CFOs align finance and business operations with company goals.

Source: PwC

Efficient Use of Labor Resources

Many CFOs rank rising labor costs and retaining talent among top concerns going into 2024. With 92% of CFOs expecting layoffs or staff reductions in 2024, efficiency is essential. Automation enables managing the same workload with limited resources or handling an increased volume of work without adding staff.

IT Teams

IT Teams say their top three priorities are cybersecurity, cloud-first adoption, and digital transformation – all of which AP automation supports.

Built-In Security

The right AP automation tools will include robust user access controls, role-based permissions, and authentication protocols to protect sensitive financial data. Required approval chains and rules-based automation provide proper oversight.

Cloud Based Management

Without on-site infrastructure, system maintenance and upgrades are handled by your automation provider, freeing up resources and capital. Cloud data storage also enhances security and compliance over localized servers.

Digital Transformation

An analysis by Deloitte shows that digital transformation has the potential to create $1.25 trillion in value across Fortune 500 companies. Automation unlocks productivity and insights, helping accelerate this transition. For example, APIs can connect AP data seamlessly within enterprise rising planning (ERP) tools and human capital management (HCM) platforms.

Procurement Teams

Procurement teams benefit from Accounts Payable automation in a variety of ways, beginning with real-time visibility of spending patterns and contract compliance. Faster processing times from automated invoice matching ensure payments are made on time, resulting in better vendor relationships. Companies may also capture more early pay discounts that materially reduce costs. This is especially true with an end-to-end Procure-to-Pay solution that streamlines the requisition, approval, purchase order (PO) generation, invoice approval, and payment process.

Automating POs and approvals adds spending controls to limit unauthorized spending. When routine tasks like PO generation can be automated, procurement teams have less tedious manual work to do. Rich data and insights generated also inform future procurement policies, purchasing, and negotiations by tracking vendor performance against deliverables.

C-Suite

C-suite executives face tough decisions in 2024 as they grapple with concerns about high costs, labor shortages, and a looming economic slowdown. AP automation provides key insights to help CEOs and other C-suite executives stay ahead of the game and optimize financial management.

Real-Time Financial Insights

Instant visibility into cash commitments, AP aging, and vendor payments supports effective working capital management and data-driven decisions on capital allocation, budgets, and strategic plans.

Measurable Cost Saving

Automation streamlines operations across finance and AP, generating ROI through reduced labor, paper, and postage costs. When CEOs don’t need to directly manage operations, freeing up resources and capital allows for investments in other revenue-producing areas.

Data for Strategic Planning

Likewise, spend analytics reveal current costs down to granular categories, providing the hard data industry leaders need when making difficult decisions or exploring expansion, contraction, or mergers and acquisitions activity.

Effective Management with AP Automation

Companies deploying automation are streamlining operations, saving time and money, and improving efficiency across the entire organization — providing data and insights allowing business leaders to manage more effectively. The internal benefits are clear, but vendors also benefit from accelerated payments and full visibility into invoice status and payments. As automation leverages artificial intelligence to evolve and learn, AP automation’s impact across organizations and vendors will only grow.

Ready to take your AP process to the next level? Our Complete Guide to AP automation is your roadmap.